Monday, September 21, 2009

3 Healthy Meals for the Lazy Morning

#1: Trader Joe's Chocolate Whey Protein shake. I mix 2 scoops of the protein to a small glass of milk. It tastes very good. It does not have any artificial sweetener, but does have 9 grams of sugar. I will also have a piece of whole wheat toast to start the day with a complex carb. I've lost a few pounds since I am not hungry after I drink a shake, and there are not that many calories per serving (about 200).

The consensus seems to be that it is better to buy the whey protein rather than the soy protein. I have not tried the hemp protein, only because it is more expensive. Apparently there are many reasons soy is not preferred; but the biggest for me is that whey tastes better.

Unfortunately I could not find an exact substitute protein at GNC for when I can't get to Trader Joe's. GNC sells the Pro Performance, a product recommended by my friend's doctor after gastric bypass surgery. I like the Pro Perf. unflavored whey protein, but not as much as TJ chocolate. The unflavored Pro Perf. has no sugar and no artificial sweetener, so I add it to fruit smoothies and oatmeal. There is no taste, but it does make your food really thick. If you have a hard time adjusting to the texture, try it at least two more times and you will find you get used to it quickly.

#2: Speaking of smoothies. Just pick up the cheapest large non-flavored yogurt container (best price is at the super Wal-Mart for $1.79) and add frozen strawberries and frozen blueberries in a blender.

The strawberries should be organic, since of all the different fruits, they have the most pesticides. One study showed 36 different pesticides! But I couldn't tell if it was an organic farm that sponsored the study. You just can't win, I know. That means back to Trader Joe's, since they have the best price on organic frozen strawberries.

#3: For oatmeal, try the Trader Joe Instant Organic Blueberry Oatmeal. Just add water and microwave for one minute. Then add the unflavored protein. This is yummy and fast. If you can't get to a TJ, make a huge pot of oatmeal from scratch and just microwave a bowl the next few mornings. Don't add dried fruit though. Too many carbs. Throw in frozen blueberries instead.

My goal for the past year is to increase the amount of protein per meal. I want to eat 25 g of protein per meal. Then I am too full to snack on the dreaded addictive simple carbs.

These are just a few ideas to eating healthy and keeping the weight down. Check back since I will be adding more tips soon. I especially welcome any ideas that you are willing to share.

Saturday, September 5, 2009

Warts -- Duct Tape vs. Dermatologist

Makes sense, right?

Wrong. Every visit to this doctor's office made her wart situation worse. First they tried freezing them with liquid nitrogen. Nothing happened so they tried a second time. Again the warts did not shrink. They then used an acid to burn the warts. This procedure was performed two different times, and both times resulted in large, yellow blisters, as intended. But unfortunately new warts grew around the outer circles of the larger blisters. Finally, after many months and painful visits to the dermatologist, and the warts growing and spreading during this time, the doctor suggested surgery to remove the warts, which would leave scars all over her hands.

We high-tailed it out of there.

I can't find the picture of her hands after the treatments at the doctor's (dang) but it is unbelievable. The back of her left hand was almost entirely full of huge warts, and two fingers on the other hand were covered with warts.

At this point my mother suggested duct tape, and we thought "why not"? We bought regular, then clear, then finally opaque duct tape at Menards (which blended in with the skin color better). It was a huge effort that took about four months. Although Anne had about 15 warts, some as big as inch in diameter, they all cleared without leaving any scars or marks.

The secret? The tape has to stay on ALL the time in order to "suffocate" the warts. My husband and I constantly cut circles of the tape slightly larger than each wart. The tape would fall off or get wet, and we just cut new sections. Some people suggest only 6 days but that is not long enough. We did not use an emery board on the warts. We just kept the tape on until they disappeared, for weeks. Anne wasn't thrilled with the tape at first, but when she could actually see the warts getting smaller and flatter after just the first week or so, she was just as determined as we were.

While this treatment is not easy to do and requires determination, it is free, painless, effective, and better than any other alternative we tried. Thanks, Mom!

What is disheartening is that the next time I went to the dermatologist (for another reason), I explained to him how the duct tape eliminated her warts, thinking he would be interested in order to help other patients. He dismissed my comments, vaguely saying that the warts probably cleared on their own. Huh? Fortunately his nurse was excited and planned to pass this information along.

Yes, we finally switched to a new doctor.

Monday, August 10, 2009

Law Eliminates Nasty Surprises

... not change interest rates unless the customer is more than 60 days behind on a payment,

... provide a 45 days' notice of any increase plus an explanation,

... restore the previous rate if the consumer pays the minimum balance on time for six months,

... not enact any retroactive rate increases,

... post credit-card agreements online,

... require a co-signer for new credit card applicants 21 years old or younger, unless they prove they have the means to pay the debt,

... mail monthly statements at least 21 days before a payment is due,

... and show how many months it will take to pay off your total balance if you only pay the minimum.

Tuesday, August 4, 2009

How to Raise Your FICO Credit Score

I didn't think it would be that difficult to write up this piece on improving your FICO score, especially since I analyzed credit reports for a living at one point. Boy was I wrong.

To back up for a second, a FICO score is a number that summarizes your credit risk -- the likelihood of defaulting on a loan based on your financial history and current debt balances.

This score is constantly updated and provided by three major credit-reporting agencies: Equifax, TransUnion and Experian. The score can range from 300 to 850. You have to pay a small fee to get this score since it is not included in the credit report.

You are entitled to one free credit report a year from the three agencies, which you can get at http://www.annualcreditreport.com/. Be sure to order the reports from all three agencies, since the reports may vary slightly because not all lenders report to all three agencies. Check the reports carefully for errors that could hurt your score. If you find any errors, the agencies are required to investigate disputed items.

Why should you care about your score? Primarily since it is one factor used by lenders in deciding whether to give you a loan and at what interest rate. A score of 760 or higher will get you the lowest interest rate on a mortgage.

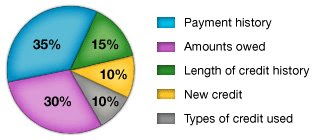

These are the categories used in determining your FICO score, per myfico.com: The first two categories are easy to understand: pay your bills on time and lower your credit card debt, and your score will go up.

The first two categories are easy to understand: pay your bills on time and lower your credit card debt, and your score will go up.

You need several months of on-time payments to raise your score, while a single late payment will lower the score. Even though there are new FICO rules coming out this year that will not penalize the score as much for one or two late payments, always pay your bills on time. Your top priority is paying your mortgage payment on time. If you do miss a payment deadline, call your creditor before they report the late payment to the credit bureau. Most creditors will not report the late payment until more than 30 days have past.

Here is something scary: although your bank may grant you a "grace period" in which you are allowed to pay the mortgage a few weeks past the due date, some banks will still report the payment to the credit bureaus as late. Call your bank to verify they do not report these payments if this applies to you.

Make credit card payments as soon as you get the bill, since some credit card company will sit on payments for weeks to mark it late in order to charge a large fee.

Lower credit card balances to 10% or less than the credit card limit to lower your score. Pay off your debt rather than moving it to another card. Don't open new credit cards just to increase your available credit, since it will lower your credit score.

Basically, the next 3 categories ask the same question: whether or not to open new credit cards. Opening an account while you are young will help the “Length of Credit History” category over time. At first your score will be lowered with a new credit card per the “New Credit” category, since new credit is considered riskier. Ignore the category “Types of Credit Used”, since myFICO states it probably won't raise your credit score. Just open the one card and make timely payments.

Searching for new credit is a negative. Instead read the credit card details and apply for only one or two cards. But comparing home and auto loan rates will not impact your score. And you can check your own credit report without affect your score.

MyFICO suggests that you don't close unused credit cards. But unless you are in the market for a loan in the near future, close as many credit cards as possible. Even thought your score will drop a little at first, your FICO score is not nearly as important as getting out of credit card debt. Yes, you would be penalized for getting out of debt. No, it does not make any sense.

Also, myFICO suggests you re-establish your credit history by opening new accounts responsibly and paying them off on time. Again, this is entirely unrealistic. If you had trouble with credit card temptation in the past, you probably will in the future, and your credit score is not nearly as meaningful as living debt free.

The bottom line is if you are very responsible, open one credit card, make timely payments, and over time your score will increase.

But if you have trouble with high credit card debt, just focus on eliminating your credit cards altogether, since you don't even need one.