I didn't think it would be that difficult to write up this piece on improving your FICO score, especially since I analyzed credit reports for a living at one point. Boy was I wrong.

To back up for a second, a FICO score is a number that summarizes your credit risk -- the likelihood of defaulting on a loan based on your financial history and current debt balances.

This score is constantly updated and provided by three major credit-reporting agencies: Equifax, TransUnion and Experian. The score can range from 300 to 850. You have to pay a small fee to get this score since it is not included in the credit report.

You are entitled to one free credit report a year from the three agencies, which you can get at http://www.annualcreditreport.com/. Be sure to order the reports from all three agencies, since the reports may vary slightly because not all lenders report to all three agencies. Check the reports carefully for errors that could hurt your score. If you find any errors, the agencies are required to investigate disputed items.

Why should you care about your score? Primarily since it is one factor used by lenders in deciding whether to give you a loan and at what interest rate. A score of 760 or higher will get you the lowest interest rate on a mortgage.

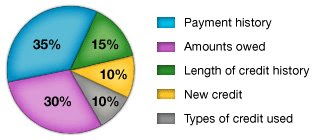

These are the categories used in determining your FICO score, per myfico.com: The first two categories are easy to understand: pay your bills on time and lower your credit card debt, and your score will go up.

The first two categories are easy to understand: pay your bills on time and lower your credit card debt, and your score will go up.

You need several months of on-time payments to raise your score, while a single late payment will lower the score. Even though there are new FICO rules coming out this year that will not penalize the score as much for one or two late payments, always pay your bills on time. Your top priority is paying your mortgage payment on time. If you do miss a payment deadline, call your creditor before they report the late payment to the credit bureau. Most creditors will not report the late payment until more than 30 days have past.

Here is something scary: although your bank may grant you a "grace period" in which you are allowed to pay the mortgage a few weeks past the due date, some banks will still report the payment to the credit bureaus as late. Call your bank to verify they do not report these payments if this applies to you.

Make credit card payments as soon as you get the bill, since some credit card company will sit on payments for weeks to mark it late in order to charge a large fee.

Lower credit card balances to 10% or less than the credit card limit to lower your score. Pay off your debt rather than moving it to another card. Don't open new credit cards just to increase your available credit, since it will lower your credit score.

Basically, the next 3 categories ask the same question: whether or not to open new credit cards. Opening an account while you are young will help the “Length of Credit History” category over time. At first your score will be lowered with a new credit card per the “New Credit” category, since new credit is considered riskier. Ignore the category “Types of Credit Used”, since myFICO states it probably won't raise your credit score. Just open the one card and make timely payments.

Searching for new credit is a negative. Instead read the credit card details and apply for only one or two cards. But comparing home and auto loan rates will not impact your score. And you can check your own credit report without affect your score.

MyFICO suggests that you don't close unused credit cards. But unless you are in the market for a loan in the near future, close as many credit cards as possible. Even thought your score will drop a little at first, your FICO score is not nearly as important as getting out of credit card debt. Yes, you would be penalized for getting out of debt. No, it does not make any sense.

Also, myFICO suggests you re-establish your credit history by opening new accounts responsibly and paying them off on time. Again, this is entirely unrealistic. If you had trouble with credit card temptation in the past, you probably will in the future, and your credit score is not nearly as meaningful as living debt free.

The bottom line is if you are very responsible, open one credit card, make timely payments, and over time your score will increase.

But if you have trouble with high credit card debt, just focus on eliminating your credit cards altogether, since you don't even need one.

3 comments:

I think checking your score dings you a few points but I’ve never seen my FICO score before and am very happy with my number (I’ve only had a credit card for a little over a year now) so it was worth it for peace of mind.

Congrats on your good score!

Keep in mind that you will not be penalized for checking on your own FICO score.

Wow, I didn't think the grace period for the mortgage would be an issue. We have been paying ours around the 15th of the month before the 16th deadline because our other bills are due at the first part of the month, so I better hurry and call the bank to find out if that is a problem! Thanks for the tips!

Post a Comment